If you’re selling EdTech, you’ve noticed that 2020 and now 2021 are not the same by huge orders of magnitude.

Reps everywhere are complaining to Learning Counsel leaders that they “can’t reach prospects,” even after someone in a school or district expressed interest. Meanwhile, school and district leaders have expressed enormous rage at vendors for barraging them with “free this and free that,” which they know isn’t really free. Administrators are highly distracted with the open-or-closed roller coaster, delivering any learning at all while trying to reorganize, a mass loss of students to alternatives, coincident loss of teachers and outright union fights, trying to obtain Chromebooks in a shortage, trying to get teachers the professional development they need, managing tons of teachers literally in stages of grief and overwhelm, and witnessing a 51 percent loss in student achievement.

Yes, they want EdTech. They do NOT want to work for it. This means your old sales techniques and marketing are not going to work as well. There’s more, though.

Your marketing people and CEOs need to get used to spending more money to get less.

Nationwide the education market is in an “inflationary” moment where the cost of attention just went way up from most media or events providers.

FYI, that’s not so with Learning Counsel events, which actually went down in cost by 38 percent and are showing better returns. Once one-day workshops averaged 35 attending administrators with a couple of teachers mixed in across thirty cities a year and reps and companies were usually thrilled with the quality of attendees. If they truly interacted, chatted people up during lunch and gave a bang-up presentation, they got long-term relationships and deals. The big differentiator was quality, not quantity and there are very particular secret-sauce ways that the Learning Counsel did this that has been meticulously recreated with virtual events.

Learning Counsel virtual regional events now get an average of 55 live attendees with 20 percent higher registration and three times the leads because the recordings can also drive online leads. Costs are down, quality and quantity are up.

This is not what is happening, though, with other events and media.

The biggest inflationary area in 2021 will be social media marketing because they are now cancelling and labeling people and groups and individual posts with negative inferences contrary to the poster’s wishes. This might seem like a good idea to some, but to the other 50 percent of the country, this is very bad and millions of people are quitting the biggest social media sites or letting their accounts go unused since they are unable to delete their accounts 100 percent. Besides other new sites like Gab and Knowstory, the big new trend is bookmarking of direct news media sites, using news conglomerator sites and using media apps rather than social media for information.

To marketers, this means a huge portion of the market is moving to active rather than passive browsing, where social media like Twitter and Facebook were once a unified “go to.” During the pandemic, a new theme emerged of active social media such as Instructables and TikTok and Instagram to replace the passivity which people saw while in isolation was a thing they used to do to relax when not driving or attending real social functions or working. Now that they weren’t going, going, going everywhere, the need for passivity time evaporated and was replaced by something that was far more active to balance things out.

Attention is fracturing and becoming more expensive

National events have all gone virtual and most big trade shows will never be back in the same way. Attendance virtually is down by 35 percent at the big conference live events. Out-of-state travel will be frowned upon, perhaps in perpetuity, now that it has big liabilities for any school when anyone could come back from a “hot zone” unknowingly bringing another breakout from some new Coronavirus “variant.” Leaders have learned how to really use virtual for internal meetings and justifying travel is going to get a lot harder. This already happened in the private sector years ago but is “really real” now in education.

Regional events by smaller associations are still available in the thousands for vendors to do, but two other things happened with them. One, many of them have now disallowed vendors to participate or to do anything meaningful other than put their logo on the event. Second, there are far fewer of these since many of the smaller associations have folded. They are also down by 45 percent in attendance and typically had very low deal creation because they are mostly teachers and not administrators. Costs to participate as a vendor might have been low, but the cost to organize hundreds of the small venue events and have reps participate was high.

Internal marketing events by vendors sometimes cite huge numbers of attendees, but these are usually either training events for new customers and not really sales events or are retention events for existing customers to get news so they will renew subscriptions.

What this means is that, on average, companies can expect to spend more to get less across most available marketing potentials.

Sluggish Pipelines

Companies are reporting sluggish pipelines. The numbers of times you have to try to reach someone is up from nine to a whopping twenty-two or more. Then your rep might hear some glimmer of hope only to be ghosted again for a meeting set-up for another month or longer.

This means sales are moving slowly for new accounts, and sometimes for renewals or subscription expansions. This is to be expected given the very high volume of administrator distractions.

Email Blocks & Contact Turnover

Many districts now have universal email blockers for any volume email incoming. This means companies sometimes have to work to get their email URL approved to go into any contact in a district at all.

The bounce rate is also very high because retirements in education are very high. The Learning Counsel’s new names turnover in just eight months was over 75,000 for our main newsletter lists. The contact turnover for reps is also very high, meaning the cost to get into new accounts is also high, both time and numbers of attempts. The turnover is also affecting the cost of renewals, where key champions may have retired or moved on.

The plus side of all the change is working with an organization like the Learning Counsel that has been in direct relationship for years with mid-tier executives, many of whom have moved up to Superintendency positions.

Odd Variances in Titles of Sales Influencers

Where once sales reps and marketers tried to narrowly define their target titles, any extremely narrow definition will now work against them. In a recent survey by the Learning Counsel, a range of titles was given to simplify analysis. 30 percent of the responses volunteered their specific titles in the “other” fill-in option. Upon review of those titles, all would have fit into the ranges, but the respondents chose to construe the categories as inapplicable. That is what sales and marketing staff run into when they attempt to sell into education institutions: a variance of how titling is done and what each institution actually has that person doing. Teachers show up frequently as heavy influencers or are sent to attend virtual events as stand-ins for higher-level administrators. Treating them like “just a teacher,” in big system sales would be an error.

Many times, higher level titles are very behind in understanding the true landscape of EdTech, and reps need to educate them about how their product fits into a broader scenario. Charging all the way to the highest levels and bypassing the decision makers lower in the chain of command could derail any hope of selling that institution. The reverse could also be true, where the lower levels have a prior favorite and no will to hear about anything else, so bypassing to higher levels is one way and another is to go lower, to the teaching ranks. Mid-tier executives may also be mere gatekeepers of an unruly conglomerate of digital things, letting teachers and superintendents chose things that they then just work to integrate and make known. Another facet is a separate group over “innovation” that works to set the overarching vision but not the individual choices. Leaving them out would be detrimental but selling only to them won’t actually get the deal done.

Now is the time for EdTech sales staff to really map out any target account influencers, the decision process, the funding and the timing.

Random Urgent Demands

Most reps are experiencing “selling-while-answering-random-demands” now in EdTech. This could be a feature or function they are told is essential to closing a deal. This backlashes on the rest of the organization and creates havoc. Most reps are not trained to manage these issues for a win-win short and long-term.

Other times, a random and urgent demand comes in the form of massive bid paperwork to be done in record time, swamping the sales process so that no real account development is getting done, just responding.

Companies will also find reps are caught up in “bake-offs” in 2021 as districts seek to move to “best in class” digital curriculum and will look at how much a software is being used versus others to decide to decommission a subscription. Reps who do not have the ammunition readily available to show differences and why something wasn’t being used can be caught flat-footed. All software companies need to help the EduJedi Leadership Society with their work on Digital Learning Experience and the Dictionary, so that school leaders actually know what they are talking about in the software scene. While there are usually tech-side people who inspect security and the like, on the curriculum side the sophistication is minimal for the actual utility of any one type of software. It is this issue that underlies the lack of differentiation in their thinking.

The “lack of use” issue, because of single sign-on software showing how much any one software is logged into, is a key element that haunts many companies. If they aren’t getting usage, they won’t be renewed. Yet underlying some of the lack of usage is the fact that many teachers, encouraged by leaders who are not transitioning to new structures of learning delivery, are dependent on retaining a whole group orientation and not using full-featured courseware and the higher functions now available in advanced learning software and a well-woven tapestry of other systems and integrations. Teachers might use it only minimally for remediation but using it to replace core instruction and some lecturing is out of the question.

So, the question is not your software, it’s the habits and organizational construct which unfortunately traps teachers into too much digital traffic and little time to personalize and give lagging students extra time – right when leaders can easily see that extra time means a social-emotional gain so desperately needed right now to drive achievement. In some instances, it is this conversation that needs to take place with leaders. The leading of a new hybrid of high-quality digital alongside a more refined use of human teaching is what technology is supposed to be doing anyway. “Letting” teachers chose willy-nilly while maintaining a teacher-centric whole group orientation is the recipe for overwhelming teachers and burning them out. “Leading” in 2021 digitally means wading in to normalize some automation for real.

Companies who have such great courseware, digital collections and whole systems are finding their lead generation is very expensive. They tend to float in to working with various media companies like Learning Counsel and then go missing again for a while. This is typically traced to one rep who said an event “failed” and they didn’t get any business from it. This rep normally was not fully engaged in the event in question, most probably needed to blame something other than themselves, and was fired later for lack of sales. The sadness lingers anyway, for all parties.

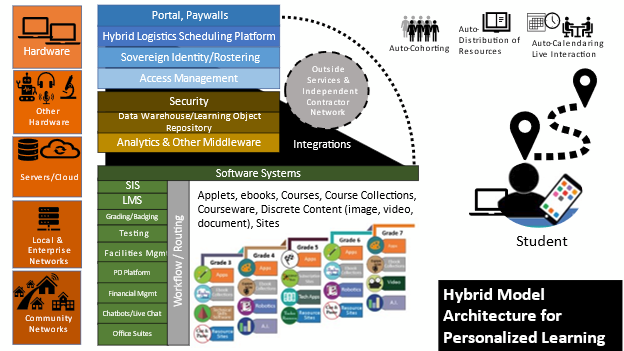

Yet it was probably not the event, and it wasn’t the rep, it was the marketing approach for a product that needs a lot more foundational build-up of understanding of true digital transition in education by the leaders being targeted. People can’t buy what they don’t understand or see the niche for. The true transition is not just more and more tech on the backs of every teacher. It is an actual transformation of the institution. First to understand the landscape of tech, to be able to easily label any product into categories of utility, then to interrogate individual function more finely, and finally to create a full model architecture of digital things working in unison and lead forth their army of teachers in a new service structure array for personalizing learning for all their students.

A rep selling into the confused minds of educators who are hit daily with math this, and history that, and repository this, and system-that, and literacy-this, who also have no grasp of things like “algorithmic inference” and “nesting” in systems cannot, I repeat, cannot make easy decisions. Every rep is selling into a maelstrom of confusion. If they’re selling easily, then somewhere some beachhead accounts were won that are working and word of mouth is filling the pipeline and the rep is usually more of an order taker than a sales wizard.

All of this is to say, reps need to understand the lay of the land and the probable future of where this is all headed. Their job right now is not just selling your product, it’s getting leaders aware of what digital operations can do and will do to change the very nature of what schooling looks like and is. Those are the reps who will be most cherished and who will sell the most. One thing that will help you understand is the Learning Counsel’s snapshot of the tech universe:

An Avalanche of Funding

As of February 8th, billions of dollars of the original CARES Act 1 was still unspent. CARES Act 2 is four times the size in monies for K12 and was just passed in December.

This means for those companies who were up in 2020 because of the first CARES Act can expect to see more increases in 2021. However, there is a catch. The money is not ear-marked for their product in particular. Competition is still out there.

Marketing and serious step-up in selling is the only guarantee your company will enjoy the fruits of the avalanche of funding in K12.

The companies who market the most will see the most reward. Sitting on the sidelines raking in word-of-mouth orders and increases in seats to subscriptions means you are leaving on the table all your potential new accounts, as expensive as they may be acquire.

The real digital transition in K12 is here. Now is the time to increase your market share in 2021 and build incrementally thereafter. You’ll need marketing reach now more than ever.

***